LVMH, Kapital, and the Startup Model of Fashion

What do you do when your favorite independent brand gets acquired?

Big news in the world of funky Japanese denim!

L Catterton, the LVMH-owned investment firm, announced the acquisition of a majority stake in Kapital, the beloved Japanese brand known for its artisanal take on American heritagewear. The announcement dropped over the weekend, while the acquisition took place at an undisclosed date in 2024. This majority stake places Kapital firmly under the control of the LVMH corporation, which adds Kapital to an expanded RTW portfolio that includes recent majority stake acquisitions of Birkenstock and Etro.

The online reaction was as swift as it was skeptical. A chorus of "RIP Kapital" comments flooded social media, an inevitable response in light of Kapital's reputation as a uniquely weird, distinctly Japanese brand that spent much of its history operating outside the mainstream confines of the fashion world.

Cards on the table: I think the Kapital-LVMH partnership is an ominous development for the fashion industry at a time when independent brands struggle to compete against the behemoths of the fashion world. As one of the uniquely successful, creatively singular brands of this past century, Kapital had a rare opportunity to chart an alternative path for brands, one that could balance financial growth and commitment to the artisanal manufacturing techniques upon which Kapital was founded. They’ve ceded those decisions to LVMH, a megacorporation owned by one of the world’s richest men.

The negative sentiments regarding LVMH's acquisition of the brand are not unlike those we experience when one of our favorite independent artists signs a major record deal. It's born out of concern that the outside influence of a major corporate entity threatens to tarnish the quality (whether creative or technical) of the product itself.

In order to appreciate the anxiety that the LVMH acquisition of Kapital inspires, it’s worth exploring the origins of the brand itself.

The Making of Kapital

Kapital (originally named "Capital") was founded in 1985 by Toshikiyo Hirata, a former karate teacher who became inspired to make jeans after encountering mid-century American denim on a business trip to the United States. After constructing his first denim factory in the Kojima District of Okayama (known as Japan's denim capital), Hirata launched the Kapital brand in 1985.

Kapital spent the first decade-plus of its existence in relative obscurity. Largely unknown outside of industry circles, the label was known more for its factory operations and manufacturing techniques than for its in-house ready to wear.

The 1990’s were a formative decade for Kapital in terms of technical development, with particular emphasis placed on mastering difficult construction techniques (chain stitching, hidden rivets, specialized pockets). The factory worked extensively with vintage American sewing machines, particularly Union Specials, which were (and still are) prized for their ability to produce specific types of seams and stitching patterns characteristic of classic American jeans. Born out of years of quiet obsession, Hirata's focus on artisanal production techniques became a defining hallmark of his work, though the Kapital brand was still largely unknown.

The major turning point for the brand came when Toshikiyo's son, Kiro Hirata, joined the family business in the mid-1990s. While Toshikiyo was the master of manufacturing techniques, it was Kiro (a fashion design student) who brought a more creative, fashion-forward approach to clothing design. The Hirata’s opened the first flagship store in 2001 and rebranded the company to "Kapital" in 2002.

The following decade would prove critical in developing what would become Kapital's signature style - a fusion of mid-century American heritage wear and Japanese craftsmanship paired with an experimental approach to distressing, silhouettes, and repair techniques. The brand was still relatively unknown outside of Japan, but the creative foundations for the Kapital of 2025.

Kapital experienced significant growth in the 2010s, both financial and creative. The brand gained broader recognition outside Japan through influential stockists and early online retailers in the 2010s. Their seasonal lookbook drops became highly anticipated events and helped define their distinct fusion of Japanese Wabi-Sabi and Americana. They collaborated with Louis Vuitton for the French labels Spring-Summer 2013 collection, a prescient foreshadowing of the future acquisition. By the early 2020s - a combination of organic interest and social media-driven hype had Kapital positioned as a household name in the world of luxury fashion. It was ripe for the picking.

The LVMH Rationale

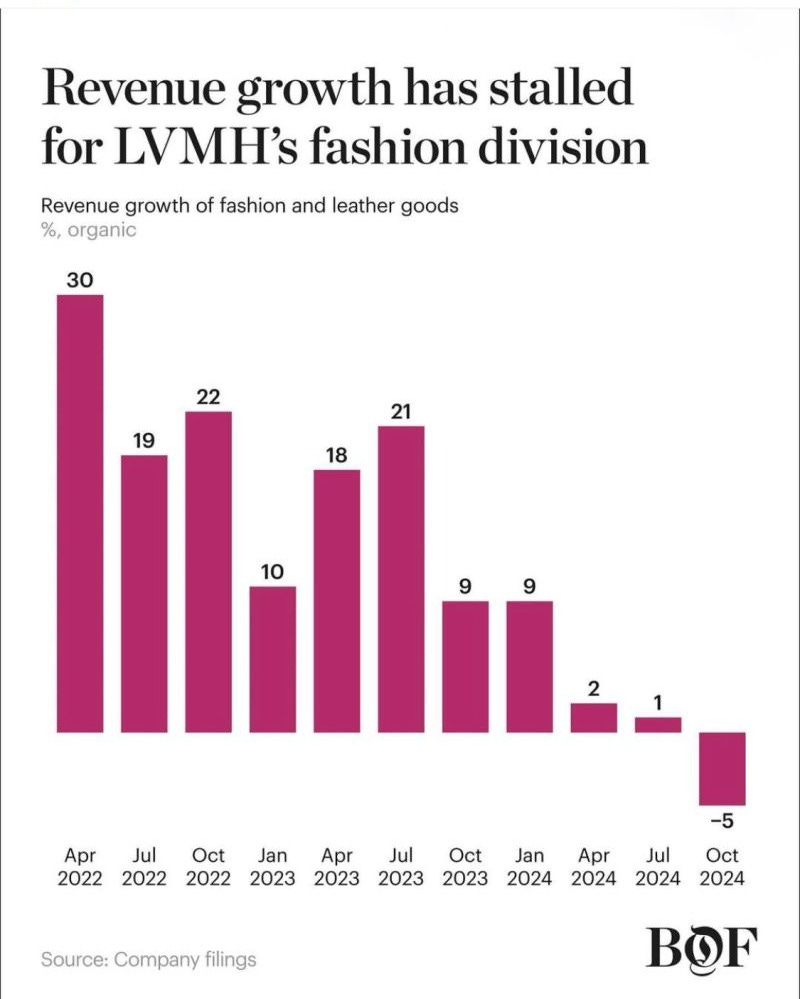

2024 wasn’t a good year for LVMH. For the first time since the COVID-19 pandemic, sales for the conglomerate’s fashion / leather goods division dropped (3% in total). Rival corporations like Kering had been noticeably struggling in the wake of a widespread consumer pullback on luxury purchases - but LVMH had been flaunting the trend with steady growth. Until 2024.

Worse still, there's been a palpable consumer narrative emerging around a growing disparity between price and quality. LVMH has aggressively raised its prices over the last half-decade - with signature items like Louis Vuitton's "Speedy 25" moving from $1000 to $1820 between 2019 and today. If these price hikes had been accompanied by a noticeable improvement in quality, they might have gone over without the same animus. But if anything, LVMH's hardcore fanbase felt quality was declining as prices rose. This is a difficult narrative to prove (there is no perfect science to assessing quality) but narratives are powerful, regardless.

The appointment of Pharrell Williams as Creative Director at Louis Vuitton hasn't managed to bottle the same kind of cultural magic that defined the success of the Virgil Abloh years. The 2021 acquisition of Tiffany and Co. doesn't seem to be setting the world on fire (2024 revenue has fallen roughly 3%). The 2024 Birkenstock IPO fell disappointingly flat, undone by a recklessly generous valuation. It makes sense to pursue new avenues for growth in light of an underwhelming year.

For LVMH, Kapital represents a rare opportunity to add a brand that thrives at the intersection of heritage fashion and emerging fashion. On one hand, the brand is uniquely Japanese in both reputation and craft, emphasizing traditional techniques like boro and sashiko. On the other hand, Kapital enjoys an increasingly global, youthful fanbase, the exact demographic an international conglomerate like LVMH hopes to appeal to as it navigates an increasingly competitive fashion landscape. It’s a rare, highly desirable combination.

The Kapital Rationale

It's been a tumultuous half-decade for the fashion industry. Decreased barriers to entry mean it's never been easier to start a fashion label, evinced by the seemingly endless lineup of emerging Instagram brands. At the same time, it's never been harder to build a financially sustainable brand. The current fashion landscape is oversaturated. Cultivating the kind of loyal customer base a label needs to thrive is increasingly challenging in a consumer environment with endless options and limited attention spans. The pandemic decimated brick-and-mortar fashion boutiques, a vital source of income for emerging brands, most of whom aren't heavily invested in costly direct-to-consumer operations.

Fashion has already begun to mirror Silicon Valley, wherein the ultimate goal of most emerging labels seems to revolve around being bought out by a competitor. While it seems strange that a label as idiosyncratic as Kapital would choose this route, the advantages are fairly straightforward:

Financial security for Kiro Hirata and his family. The money from the LVMH sale assures generational wealth for the Hirata family and inoculates them from any possible collapse in Kapital's bottom line. LVMH assumes most of the financial risk going forward.

The ability to scale. The resources LVMH can inject in the form of a global network of factories/ateliers, endless marketing budgets, and brick-and-mortar expansion would have been inaccessible to Kapital before the acquisition. If Kiro's ambition was to turn Kapital into a brand that competes with other LVMH darlings like Loewe, this was at the very least a shortcut.

The prestige that comes with being part of the LVMH portfolio. Lumbering corporate hydra that it is, LVMH is still synonymous with a gold standard of luxury that few else can lay claim to.

The Narrowing of a Brand

Kapital will be fine, from a financial standpoint. It's an iconic Japanese brand with a loyal fanbase. It's not as though Kapital has rejected commercialization in the wake of its growing popularity. You can see an increase in the repetition of certain Hypebeast-friendly design motifs - from the skull prints to the smiley faces. I don't begrudge Kapital for leaning into the items that sell, even if they're less exciting than the pieces that established the brand's unique artisanal appeal (ring coats, boro jackets, insanely proportioned military garments).

Still, I worry about the impact the LVMH acquisition will have on the core, defining elements that made Kapital a singularly great brand: The emphasis on complicated, artisanal Japanese manufacturing techniques, the willingness to take creative risks, and the unusually reasonable price points at which the brand sold its pieces.

I don't think LVMH will phase out the more expensive, time-intensive artisanal techniques like boro and sashiko. Heritage brands are built on the backs of their most iconic offerings (the LV Speedy, the Loewe Puzzle bag, etc.) - few understand this better than LVMH. It isn't like Kapital hadn't already pivoted towards a more streetwear-friendly output over the last decade.

I do worry about the willingness to take creative risks. Derek Guy put together a great thread that includes a section on the Ring Coat - a bizarrely enticing piece of American militarywear fused with traditional Japanese cuts. Will the LVMH-owned Kapital show a willingness to invent similarly weird, divisive clothing? These aren't necessarily the kind of cash cow "hero pieces" that LVMH is known for. Would a more cautious, conservative iteration of Kapital manage to retain the appeal that attracted LVMH to it in the first place? I'm honestly not sure. I won't prejudge, but I'll be monitoring closely.

Where I'm most pessimistic is on the subject of price points. One of the most important, under-discussed features of Kapital's success was how well-priced the garments were, especially the domestic Japanese retail price. Items like the iconic denim boro jacket are around $1000 in Japan, compared to the $2000 US retail. Even that $2000 feels reasonable when you envision what most leading luxury brands would charge for it.

LVMH is notorious for its aggressive pricing models, wherein the retail price of items is aggressively raised - sometimes multiple times a year. I expect they'll apply those same aggressive price hikes to Kapital items across the board, both in Japan and worldwide. Raising Kapital price points to those of other LVMH brands like Givenchy or Celine would be a financial gut punch for the brand's core customer base.

We still don't know many of the details surrounding the Kapital acquisition, including what the majority stake sold for. It remains unclear whether the acquisition portends wholesale changes (as we've seen at Birkenstock) or a more hands-off approach (such as the one at LVMH owned Loro Piana). It could end up as a win-win for both Kapital and LVMH. Everything is uncertain at this point.

Will Kapital's loyal customer base also emerge as winners? The answer to that question is the most uncertain of all.

Great historical dive into the brand. I think outside of points made in the article, I’ve seen as well that investing in Japan right now is just cheap due to the uncertain Japanese federal bank and the tailwinds of Trump in office and effects on the stock market. So for an L Catterton with its fashion forward acquisitions I imagine it’s a bit of buy and let Kapital do its thing. I’m sure this couldn’t have been heavy on the P&L comparatively to other fashion ventures.

It will be interesting in due time how the brand utilizes this acquisition (e.g., more distribution, cross collaboration with other LVMH brands perhaps), and hopefully doesn’t go by way of ALD (and soon the results of the Our Legacy investment)

loved this! appreciate your thoughts